Rudra Engineering VERSUS C.C.E. & S.T.-Vadodara-I

Service Tax Appeal No.10535 of 2013

(Arising out of OIO-15/STC/COMMR/BRC-I/2012 dated 19/12/2012 passed by

Commissioner of Central Excise, Customs and Service Tax-VADODARA-I)

Rudra Engineering

VERSUS

C.C.E. & S.T.-Vadodara-I

APPEARANCE:

Shri Anil Gidwani, Advocate for the Appellant

Shri Rajesh Agarwal, Superintendent (AR) for the Respondent

CORAM: HON’BLE MEMBER (JUDICIAL), MR. RAMESH NAIR

HON’BLE MEMBER (TECHNICAL), MR. RAJU

Final Order No. A/ 10063 /2023

DATE OF HEARING: 15.12.2022

DATE OF DECISION: 16.01.2023

RAMESH NAIR

The appellant is in appeal against the impugned order-in-original No.

15/STC/COMMR/BRC-I/2012 dated 19.12.2012 wherein the demand of short

payment of service tax has been confirmed against the appellant.

- The brief facts of the case are that intelligence was received that the

Appellant was wrongly availing abatement of 67% for calculating the

taxable value for payment of service tax as per the provisions of Notification

No. 1/2006-ST dated 01.03.2006 as amended. On this basis inquiry was

initiated and documents were scrutinized. On study of work orders and its

related invoices pertaining to thermal insulation, it was found that the scope

of work of the contract executed by the Appellant are (i) Hot insulation

including supply of LRB and Aluminium Sheet (ii) Cold Insulation with

Thermocol and Aluminium Sheets (iii) Insulation of pipeline with black

superioan sleeve providing and fixing of black superioan sleeve with

cellotape (iv) Insulation with black nitrite rubber foam, sheet, etc.. It

appeared that the service provided by the said service provider of supplying

and applying of thermal insulation falls outside the purview of eligibility

criteria for availing the benefit under Notification No. 1/2006-ST as they

were not supplying plant, machinery, equipment or structures but carrying

out application of thermal insulation material on plant, machinery,

equipment already installed at the factory /business premises of the service

receiver. In this connection statement of Shri Viral Harendrabhai Pandya

Proprietor of the firm was recorded. It also appeared that Appellant have

wrongly classified the service rendered as “Installation of thermal insulation”

as Works Contract Service as the condition of transfer of property as per the

definition did not exist and also the contract was not leviable to tax as sale

of goods. Accordingly, a show cause notice dated 8-10-2012 was issued to

the appellant for demand of service tax of Rs. 69,61,972/- on wrong

availment of abatement and demand of service of Rs. 24,37,017/- for wrong

classification of service and to impose penalty. The matter was adjudicated

and the demand of service tax was confirmed along with interest and

penalty was imposed. Against this order, the appellant is before us.

- Shri Anil Gidwani, learned Counsel the appellant submits that there is no

dispute over the fact that the Appellant was undertaking “erection,

installation and commissioning work”, wherein thermal insualting material

such as (i) Hot insulation including supply of LRB and Aluminium Sheet (ii)

Cold insulation with Thermocol and Aluminium Sheet (iii) Insulation of

Pipeline with black superion sleeve providing and fixing of black superion

with cellotape (iv) insulation with black nitrile rubber foam, sheet, etc. were

being supplied and applied on the equipment, structures etc. The sale price

of the material was not being separately shown in the invoice, however,

substantial VAT/Sales Tax under appropriate scheme and at appropriate

rates were paid. In fact, the approx.. involvement of material in the work

undertaken is about 70% of the total cost. There is no dispute over this fact,

and this was also specifically mentioned in the statements of Shri Viral

Pandya (Proprietor) recorded in the course of the investigation.

3.1 He further submits that the activities undertaken by the appellant

would qualify within the scope of the Notification No. 1/2006 –ST , so as to

be eligible for abatement benefit. The impugned order has not appreciated

this aspect properly, while the appellant has also explained the factual

position even by producing photographs for better understating of the issue.

The Notification No. 1/2006 or for that matter the provisions of Finance Act,

1994 do not define what is “Plant” As such the items supplied by the

appellant not in the nature of consumable, but an item having fairly high

degree of durability. As such, just as in the case of “wires and cables” ,even

the present items qualify as “plant” within the meaning of said items. He

placed reliance decisions of Jawahar Mills Ltd. – 1999(108)ELT 0047 (Tri. LB)

upheld by Supreme Court -2001(132)ELT 3(SC).

3.2 He also submits that items which were sold by the Appellant during

the course of executing work, have been actually purchased by the

customers/ clients and then supplied to the appellant for application, these

items would have definitely qualified as “capital goods” for the

customers/clients. There cannot be any dispute over this. If they qualify as

“capital goods” they automatically become plant/machinery/equipment and

as such, the objection raised in the present matter in this regard cannot

survive any more.

3.3 He argued that it is well documented that they were selling material in

the course of providing the composite service, and the material component

involved therein was approx.. 70% and at the most service tax was to be

paid only on 30% of the value, which represent labour component. As

against this, the appellant has paid service tax on 33% of the value, which is

more than the actual liability. The basic idea behind giving abatement is to

ensure that Service tax is not charged on that value of materials, which are

used together with labour while providing taxable service. Service tax is a

tax on services and not on goods and thus such abatement are given.

3.4 As regards the second issue “works contract service‟ which is made

liable to levy of service tax w.e.f. 01.06.07, he submits that the work

undertaken for the clients, which is in dispute, are to be treated as works

contract for the purpose of Sales Tax Laws and that the appellant also paid

Sales Tax/ VAT on material consumed during the execution of such work in

dispute. The CBEC has clarified in its circular No. B1/16/2007-TRU dated

22.05.2007 that all those contracts which qualifies works contract under the

Sales Tax Laws equally qualify as work contract for the purpose of levy of

Service tax. This is also clear from the definition of taxable service for works

contract as appearing at Section 65(105)(zzzza) of the Finance Act, 1994.

That the work undertaken by the appellant not only attract VAT/Sales Tax,

but are also qualified as “works contract”. The strange reasoning adopted in

the impugned order to hold that “there is no transfer of property” on goods

involved in execution of works is not legally acceptable. The Appellant is also

registered under works contract services and discharging service tax

accordingly since long and no further proceedings have been undertaken

against them for the same nature of work where they regularly discharge

service tax liability under works contract service.

3.5 Without prejudice, he also submits that in any case benefit under

Notification 12/2003-ST is available to the Appellant. He placed reliance on

the following decisions:-

WIPRO GE MEDICAL SYSTEMS PVT. LTD.- 2009(14)STR 43

DELUX COLOUR LAB PVT. LTD.- 2009(13)STR 605

VAHOO COLOUR LAB.-2010(18)STR 548

SOBHA DEVELOPERS LTD.- 2010(19)STR 75

HINDUSTAN AERONAUTICS LTD.- 2010(17)STR 249

3.6 He also submits that in the present matter benefit of “cum-tax” value

was not given to the Appellant which is otherwise available as per law.

- Per contra, Shri Rajesh Agarwal,

departmental authorised

representative relies on the findings in the impugned order.

- Heard both sides and perused the records. The first issue involved in

the present appeal for determination is whether the appellant are eligible to

the benefit of Notification No. 1/2006-S.T., dated 1-3-2006. The relevant

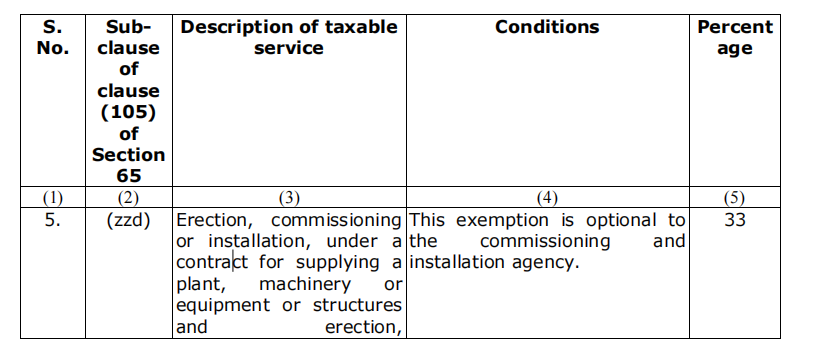

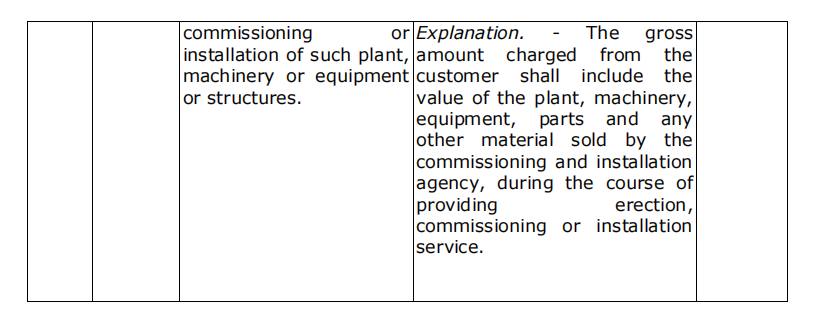

entry specified in said notification reads as follows :

The aforesaid exemption entry is applicable on taxable category viz.

Erection, commissioning or installation, under a contract for supplying a

plant, machinery or equipment or structures and erection, commissioning or

installation of such plant, machinery or equipment or structures. The

Learned Commissioner denied the benefit of said entry to the Appellant on

the ground that Appellant is not supplying plant, machinery, equipment or

structures, but carrying out thermal insulation and hence benefit of 67%

abatement from gross value would not be available to appellant as the

condition laid down in the said Notification are not fulfilled by appellant.

However, we find that in above column (4) of the table which is related to

the “condition” in explanation it clearly used the words “and any other

material sold by the commissioning and installation agency, during the

course of providing erection, commissioning or installation service”. Hence,

in our opinion, it cannot be considered that the said entry is applicable only

on the supply of plant, machinery or equipment or structures. Besides, it is

also applicable on any other material soLearned In the present matter there

is no dispute on the facts that the Appellant is Commissioning and

Installation agency and for providing the taxable services appellant has

provided the thermal insulating materials i.e. Hot insulation including supply

of LRB and Aluminium Sheet, Cold insulation with Thermocol and Aluminium

Sheet, Insulation of Pipeline with black superion sleeve providing and fixing

of black superion with cellotape , insulation with black nitrile rubber foam,

sheet, etc. and on supply of goods appellant also paid sales tax/ VAT. Hence,

in our opinion, the Appellant are eligible to the benefit of the Notification No.

1/2006-S.T., dated 1-3-2006.

5.1 The second issue in the present appeal is wrong classification of

service under Works Contract Service. As per the revenue the appellant –

service provider has wrongly classified the service rendered as „installation of

thermal insulation‟ as „Works Contract‟ in as much as the condition of

transfer of property as per the definition of „Works Contract‟ has not satisfied

& also the contract is not leviable to tax as sale of goods and appellant only

supply the insulation material and used the same towards completion of

thermal insulation. We find that the Works Contract Service was introduced

by the Finance Act, 2007 w.e.f. 1-6-2007 by insertion of sub-clause (zzzza)

in Section 65(105) of the Act. The provision reads as under :

(zzzza) to any person, by any other person in relation to the execution of a

works contract excluding works contract in respect of roads, airports

railways, transport terminals, bridges, tunnels and dams.

Explanation : For the purposes of this sub-clauses, “works contract” means a

contract wherein, –

(i)

Transfer of property in goods involved in the execution of such

contract is leviable to tax as sale of goods, and

(ii)

Such contract is for the purposes of carrying out, –

(a)

erection, commissioning or installation of plant, machinery, equipment

or structures, whether pre-fabricated or otherwise, installation of electrical

and electronic devices, plumbing, drain laying or other installations for

transport of fluids, heating, ventilation or air-conditioning including related

pipe work, duct work and sheet metal work, thermal insulation, sound

insulation, fire proofing or water proofing, lift and escalator, fire escape

staircases or elevators; or

(b)

construction of a new building or a civil structure or a part thereof, or

of a pipeline or conduit, primarily for the purposes of commerce or industry;

or

(c)

construction of a new residential complex or a part thereof; or

(d)

completion and finishing services, repair, alteration, renovation or

restoration of, or similar services, in relation to (b) and (c); or

(e)

turnkey projects including engineering, procurement and construction

or commissioning (EPC) projects.

From the definition of Works Contract Service, it is clear that only specified

categories of works contract are considered for levy of Service Tax under the

said definition. These are enumerated in clauses (a) to (e). We find that in

clause (a) thermal insulation also mentioned and in the present matter

appellant had also paid VAT/ sales tax on goods which is used in installation

of thermal insulation. We find that the impugned activity of the assessee was

nothing but “works contract service”.

- In view of the above clear position of law, we do not find any merit in

the impugned order demanding service tax from appellant. Therefore, the

impugned order is set-aside. The appeal is, accordingly, allowed with

consequential relief if any as per law.

(Pronounced in the open court on 16.01.2023 )

(RAMESH NAIR)

MEMBER (JUDICIAL)

(RAJU)

MEMBER (TECHNICAL)