Pm Products VERSUS C.C.E.-Ahmedabad-ii

Excise Appeal No. 11558 of 2013

(Arising out of

OIO-22-COMMR-AKG-AHD-II-2013

dated

12/04/2013passed by

Commissioner of Central Excise-AHMEDABAD-II)

Pm Products

VERSUS

C.C.E.-Ahmedabad-ii

APPEARANCE:

Shri P.P Jadeja, Consultant appeared for the Applicant

Shri Vijay G Iyengar, Superintendent (AR) for the Respondent

CORAM: HON’BLE MEMBER (JUDICIAL), MR. RAMESH NAIR

HON’BLE MEMBER (TECHNICAL), MR. RAJU

Final Order No. A/ 10155 /2023

DATE OF HEARING: 24.01.2023

DATE OF DECISION: 25.01.2023

RAMESH NAIR

The brief facts of the case are that the appellant is the manufacturer of

Pan Masala containing Tobacco commonly known as “Gutkha” falling under

CTH 24039990 of the First Schedule of Central Excise Tariff Act, 1984. The

appellant was operating under the Pan Masala Packing Machines (Capacity

Determination and Collection of Duty) Rules, 2008 and they had followed the

said rules and regulations.

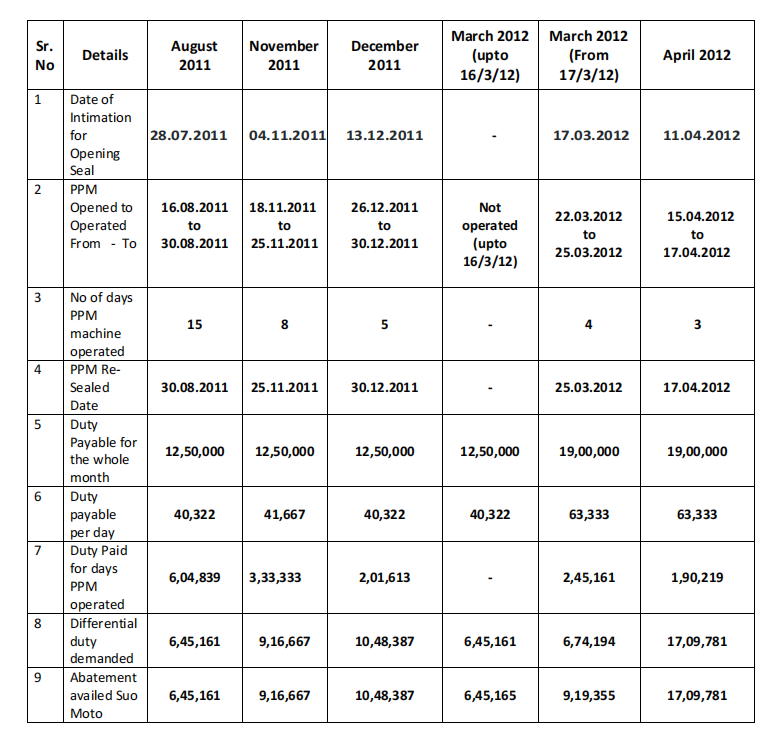

1.2 The appellant has paid the duty under the compounded levy scheme

for the days of operation of the machine in their factory under intimation

of jurisdictional officer and de- sealing and re-sealing of the machine was

taken place under the supervision of the jurisdictional officer. The appellant

also availed the abatement of duty for the days the machine was sealed and

not in operation. The details are given in the following chart.

1.3 Revenue observed that during August- 2011 , November-2011,

December- 2011, March-2012 & April, 2012 appellant had not paid the

duty for the entire month but paid only for the numbers of days their

machine was operated. Accordingly, the show cause notice bearing F. No

V.24/15-59/OA/2012 dated 06.08.2012 for recovery of Central Excise Duty

amount of Rs. 56,39,351/- was issued. The said show cause notice was

adjudicated by the Adjudicating Authority vide impugned order in original

No. 22/ COMMR/AKG/AHD-II/2013 dated 15.04.2013 wherein OIO has

confirmed the Central Excise duty demand of Rs. 56,39,351/- with interest

and penalty of Rs. 2,80,000/-. Hence the appellant has filed the present

appeal before this Tribunal.

- Shri P.P Jadeja, Learned Consultant appearing on behalf of the

Appellant submits that the Adjudicating Authority has demanded the duty

for the days for which the machine was not in operation. The contention

of the Adjudicating Authority is that the appellant was supposed to pay duty

for the entire month and thereafter they should have claimed the

abatement. It is his submission that there is no condition in the Rules that

for the days of closure of the machine first duty should be paid and then

claim the refund. Therefore, the entire order is based on the

contention which does not have support of law and therefore not

sustainable. It is his submission that abatement of duty in principle was not

objected by the department. The meaning of abatement is to reduce the

amount of abatement. Therefore, the appellant has rightly paid the duty

only for the days for which the machine was in operation. He takes

support from the following judgments:-

CCE Vs. Kaipan Pan Masala Pvt Ltd – 2012 (285) ELT 296 (Tri. Del)

Kay Pan Sugandh Pvt Ltd vs. CCE – 2017 (353) ELT 376 (Tri. Del)

Commissioner vs. Thakkar Tobacco Products Pvt Ltd – 2016 (332) ELT

785 (Guj.)

CCE Delhi –I vs. Shakti Fragrances Pvt Ltd Unit-II- 2015 324 ELT

390 (Del.)

CCE, Kanpur Vs. Trimurti Fragrances Pvt Ltd – 2019 (370) ELT 257

(All.)

Pan Parag India Ltd Vs. CCE, Bangalore-III- 2016 (344) ELT 497

(Tri. Bang)

Shri Vijay G Iyengar, Learned Superintendent (AR) appearing on

behalf of the Revenue reiterates the finding of the impugned order.

We have carefully considered the submission made by both sides and

perused the records. We find that in the present case the appellant have

followed the procedure for taking abatement of duty provided under

Rule 10 of “Pan Masala Packing Machines (Capacity Determination and

Collection of Duty) Rules, 2008” which is reproduced below:-

“10. Abatement in case of non-production of goods. – In case a factory

did not produce the notified goods during any continuous period of

fifteen days or more, the duty calculated on a proportionate basis shall

be abated in respect of such period provided the manufacturer of such

goods files an intimation to this effect with the Deputy Commissioner

of Central Excise or the Assistant Commissioner of Central Excise, as

the case may be, with a copy to the Superintendent of Central Excise,

at least seven days prior to the commencement of said period, who on

receipt of such intimation shall direct for sealing of all the packing

machines available in the factory for the said period under the physical

supervision of Superintendent of Central Excise, in the manner that

these cannot be operated during the said period:

Provided that during such period, no manufacturing activity,

whatsoever, in respect of notified goods shall be undertaken and no

removal of goods shall be effected by the manufacturer:

Provided further that when the manufacturer intends to restart his

production of notified goods, he shall inform to the Deputy

Commissioner of Central Excise or the Assistant Commissioner of

Central Excise, as the case may be, of the date from which he would

restart production, whereupon the seal fixed on packing machines

would be opened under the physical supervision of Superintendent of

Central Excise.”

From the plain reading of the above Rule 10 it is clear that the abatement

is available to the appellant on following the condition laid therein. As

per the condition the appellant has to intimate the jurisdictional officer in

advance regarding sealing and de-sealing of the machines. In the present

case there is no dispute that the intimation was given well in advance

and the Jurisdiction Range Superintendent has de-sealed and re-sealed

the machine and the machine was operated only during that period. From

the above Rule 10 we do not find any provision for payment of duty for the

whole month and thereafter to claim refund on account of abatement of

duty. There is no dispute even by the department that the appellant is not

liable to pay duty during the period when the machine was not in operation.

The contention of the Adjudicating Authority is that the appellant was

supposed to pay the entire duty first and thereafter claim the refund. In

the present case, the appellant is eligible for abatement in principle and

under no circumstances the full duty can be demanded for the period of

abatement when the machine was not in operation. This issue has been

considered in various judgments .

4.1 In the case of Commissioner vs. Thakkar Tobacco Products Pvt Ltd –

2016 (332) ELT 785 (Guj.)the Hon’ble Gujarat High Court considered the

same issue and passed the following judgment:

- The facts of the case are required to be examined in the light of

the above statutory provisions. From the facts noted hereinabove, it is

apparent that the assessee did not produce the notified goods during a

continuous period of fifteen days in the month of March and

accordingly claimed that it was entitled to abatement of duty on a

proportionate basis for the period when the factory was not producing

notified goods and accordingly adjusted duty to that extent from the

duty payable in the month of April. The contention of the Revenue is

that abatement amounts to refund and, therefore, the procedure for

availing refund as laid down under Section 11B of the Act is required

to be followed. In this regard, it may be noted that the expression

“abatement” has not been defined anywhere in the Act or in the PMPM

Rules. Therefore, the popular or dictionary meaning of the said

expression is required to be looked into. In Black’s Law Dictionary, the

term “abatement” has been defined as a reduction, a decrease, or a

diminution; the suspension or cessation, in whole or in part, of a

continuing charge, such as rent. In the context of tax, abatement has

been stated to be diminution or decrease in the amount of tax

imposed. In the New Oxford Dictionary of English, “abatement” has

been defined as the ending, reduction or lessening of something. In

the Dictionary of English Language, “abatement” has been defined as

an amount abated, a deduction from the full amount of tax. On the

other hand, “refund” has been defined as to pay back “money” to give

or to put back. Tax abatement is ordinarily known as reduction of or

exemption from tax by a Government for a specific period. A tax

incentive is also stated to be a form of tax abatement. Thus, the

ordinary meaning of abatement is reduction, diminution and,

therefore, when an assessee is entitled to abatement of duty, he is

entitled to reduction of duty to that extent and not refund thereof as is

sought to be contended on behalf of the Revenue. It would have been

a different matter if the rules prescribed for the manner in which

abatement has to be granted. However, in the absence of any rule in

this regard or any specific provision providing for the mode of availing

abatement, the course of action adopted by the respondent-assessee

cannot be said to be in violation of any rule or any provision of the Act.

As can be seen on a plain reading of Rule 10 of the PMPM Rules, the

same merely provides that in case of factory which has not produced

the notified goods during a continuous period of fifteen days or more,

the duty calculated on a proportionate basis shall be abated in respect

of such period. The abatement, however, is subject to the condition

stipulated in Rule 10, namely that, the manufacturer of such goods is

required to file an intimation to that effect with the Deputy

Commissioner of Central Excise or the Assistant Commissioner of

Central Excise as the case may be, with a copy to the Superintendent

of Central Excise, at least three working days prior to the

commencement of such period, who on receipt of such information, is

required to direct sealing of all the packing machines available in the

factory for the said period under the physical supervision of

Superintendent of Central Excise, in the manner that these cannot be

operated during the said period. Thus, subject to the fulfilment of such

conditions, Rule 10 of the PMPM Rules provides that the duty

calculated on a proportionate basis shall be abated.

- Since great emphasis has been laid on the circular dated 12th

March, 2009 on behalf of the appellant for contending that the

principle of contemporaneaexpositio guides that contemporaneous

administrative construction should be given considerable weight and

should not be lightly overturned, it may be apposite to examine the

nature of the said circular. A perusal of the circular dated 12th March,

2009 shows that the subject of such circular is “Pre- and post-audit of

abatement orders in terms of Rule 10 of the Pan Masala Packing

Machine Rules, 2008 – clarification regarding”. A perusal of the

contents of the said circular shows that the same says that in terms of

Rule 10 of the PMPM Rules, the abatement of duty is to be given in

case the factory did not produce notified goods during any continuous

period of fifteen days or more. The JDA/JAC has to pass an abatement

order in the case. The circular further says that representations have

been received from field formations regarding whether the abatement

orders need to be subjected to pre- and post-audit in the same

manner as refund/rebate orders. Thus, the subject matter of the said

circular is as to whether abatement orders need to be subjected to

pre- and post-audit. The circular further says that circulars have been

issued in the context of procedure to sanction pre/post-audit of

refund/rebate claims and as the abatement order is in the nature of

refund, they are required to be subjected to the same administrative

procedure of pre- and post-audit as laid down by the Board from time

to time regarding refund. Accordingly, it has been provided that all

Board circulars issued in the context of pre- and post-audit of

refund/rebate claims will apply mutatis mutandis to the abatement

orders also.

- Thus, the said circular proceeds on the footing that abatement

orders are to be passed by the JDC/JAC and accordingly provides for

application of circulars issued in the context of pre- and post-audit in

relation to refund/rebate claims to abatement orders. However, the

said circular nowhere provides for the procedure to be followed for

granting abatement. As noticed earlier, the Act and the PMPM Rules

are totally silent as regards the manner in which the abatement is to

be granted and do not speak of any order of abatement being passed

by the JDC/JAC. In the opinion of this Court, in the absence of the Act

or the rules framed thereunder making any such provision, no such

provision can be read into the Act and the rules.

- In the above backdrop, the merits of the impugned order may be

examined. The Tribunal, in the impugned order, has recorded that in

none of the orders impugned before it, it is in dispute that there was a

closure of the factory for more than fifteen days and the required

procedure of due intimation of closure, sealing and due intimation or

reopening was followed. Thus, there was no dispute that the

requirements of Rule 10 of the PMPM Rules had been fulfilled. There

was also no dispute that the amount adjusted was not more than the

amount of duty mandated to be abated in terms of Rule 10 of the

PMPM Rules. The Tribunal has taken note of the fact that Rule 10 of

the PMPM Rules does not make any stipulation about abatement

having to be claimed by filing an application, though it also does not

imply to the contrary. Referring to Rule 9 of the PMPM Rules, it was

observed that when the intention of the Government is that the

amount is to be refunded and an express provision is provided

therefor, whereas Rule 10 does not make any such provision. It may

be noted that insofar as Rule 96ZO of the Central Excise Rules is

concerned, sub-rule (2) thereof expressly provides for claim of

abatement being made under sub-section (3) of Section 3A of the Act,

which would be allowed by an order passed by the Commissioner of

Central Excise of such amount as may be specified in such order.

Similarly, sub-rule (7) of Rule 96ZQ provides for abatement being

allowed by an order passed by the Commissioner of Central Excise of

such amount as may be specified in such order, subject to the

conditions enumerated thereunder. Similarly, sub-rule (2) of Rule

96ZP provides for abatement being allowed by an order passed by a

Commissioner of Central Excise of such amount as may be specified in

such order subject to the fulfilment of the conditions laid down

thereunder. Thus, in relation to independent processors of textile

fabrics, manufacturers of non-alloy steel hot re-rolled products and

manufacturers of non-alloy steel ingots, who were also assessed on

the basis of annual production capacity under Section 3A of the Act,

there was an express provision for making an order of abatement

whereas the PMPM Rules are totally silent in that regard. There is no

provision for making an order of abatement under Rule 10 of the PMPM

Rules.

- As noticed earlier, Rule 10 of the PMPM Rules provides for

abatement of duty calculated on proportionate basis in case where the

factory does not produce notified goods during any continuous period

of fifteen days or more. However, such abatement is subject to the

conditions stipulated thereunder as referred to hereinabove. Once such

conditions are satisfied, the assessee becomes entitled to abatement

of duty to the extent of the days the factory did not produce the

notified goods.

- On a plain reading of Rule 10 of the PMPM Rules, it is apparent

that while the same provides that duty calculated on a proportionate

basis shall be abated, it does not provide for any procedure for doing

- Thus, whereas Rules 96ZQ, 96ZO and 96ZP of the Central Excise

Rules, 1944, which also are schemes under the compounded levy

scheme, there were express provisions for making an order of

abatement by the Commissioner, Rule 10 of the PMPM Rules is wholly

silent in that regard. Under the circumstances, having regard to the

fact that Rules 96ZQ, 96ZP and 96ZO provided for making an order of

abatement, however, there is no corresponding provision in the PMPM

Rules, it can be inferred that the rule making authority has consciously

omitted making such provision. Therefore, in the absence of any

specific provision for making an order of abatement, it cannot be said

that the action of the assessee in calculating the duty on a

proportionate basis and setting off the same against the duty payable

in the succeeding month is, in any manner, violative of the rules or the

statutory scheme.

- Besides, in the light of the findings recorded by the Tribunal to

the effect that it is not disputed that the adjustments made were not

more than the amounts of duties mandated to be abated as per Rule

10 of the PMPM Rules, the action of the respondent-assessee in

computing the proportionate amount of duty towards the abatement

and setting it off against the duty payable in the next month does not

adversely affect the revenue in any manner. The abatement, in the

opinion of this Court, is not akin to refund and means reduction or

diminution of the duty. Therefore, when the duty stands reduced to

the extent provided in the rule, there is no liability to pay the same,

inasmuch as, to that extent the duty stands abated. Therefore, if the

assessee has correctly calculated the proportion of duty and set off the

same against the duty payable for the next month, it cannot be said

that the said action is contrary to the statutory scheme. When the

rules do not provide for the manner in which duty is required to be

abated, nor do they provide that abatement shall be by an order of the

Commissioner or any authority, but nonetheless provide for abatement

of duty and the extent of entitlement to such abatement, no fault can

be found in the approach of the assessee in suo motu taking the

benefit of such abatement.

- In the light of the above discussion, it cannot be said that the

view adopted by the Tribunal is not a plausible view warranting

interference by this Court. In the absence of any infirmity in the

impugned order passed by the Tribunal, it is not possible to state that

the same gives rise to any question of law, much less, a substantial

question of law. The appeals, therefore, fail and are accordingly

dismissed.”

In the case of CCE Delhi –I vs. Shakti Fragrances Pvt Ltd Unit-II- 2015

324 ELT 390 (Del.), the Hon’ble Delhi high Court also considered the similar

issue and passed the following judgment:

“11. In the present case, the appellant had pressed into service Rule

10 of the PMPM Rules requires the duty calculated on a proportional

basis to be abated in case the factory does not produce the notified

goods during any continuous period of 15 days in a month. Rule 10

further requires the intimation to that effect to be given to the

authorities at least three working days prior to the commencement of

the period of closure. Rule 9 requires the monthly duty payable to the

authorities to be paid by the fifth day of the same month. There is

nothing in Rule 9 to suggest that the failure to pay the duty payable on

all the machines upfront by the 5th day of a month would disentitle

the assessee to claim pro rata abatement of duty. The requirement

under Rule 10 of giving intimation three days prior to the closure has

been complied with by the assessee.

- On a collective reading of Rules 9 and 10 of the PMPM Rules, the

Court is of the view that the failure to make the payment of duty on

fifth day of every month cannot result in depriving the assessee of the

pro rata abatement of duty which he is in any way entitled to since

admittedly in the present case there has been a closure of the factory

from 14th to 31st August, 2012 and an abatement order has also been

passed on 28th August, 2012. However, the assessee would be liable

to pay the interest for the period of late deposit of duty.”

The same issue has been considered by the Hon’ble Allahabad High court

in the case of CCE, Kanpur Vs. Trimurti Fragrances Pvt Ltd – 2019 (370)

ELT 257 (All.). wherein the Hon’ble court decided as under:-

“22. The sole issue under consideration is as to giving benefit of

abatement for non-production, whether the assessee could on their

own calculate Excise duty and set off the same against the duty

payable in the next month. The argument of the Department relying

upon Rule 9 of the PMPM Rules, 2008 claiming that the monthly duty

on notified goods is to be paid by 5th day of the month and the

assessee cannot simpliciter claim set off without first depositing the

same had been repelled by the Gujarat High Court in the case of

Thakker Tobacco (supra) holding that Rule 10 of the PMPM Rules, 2008

envisages a situation and provides for abatement of excise duty

calculated on proportionate basis, in case where factory does not

produces notified goods during continuous period of 15 days or more.

- Moreover, the statue, that is proviso to sub-section (2) of Section

3A itself provides for abatement where a factory producing notified

goods did not produce the same during any continuous period of 15

days or more, the duty calculated on the proportionate basis shall be

abated in respect of such period, if the manufacturer of such goods

fulfills such condition as may be prescribed. In the present case as the

assessee having complied the statutory requirement, is entitled to the

benefit claimed by him.

- The judgment in case of Thakker Tobacco (supra) having been

accepted by the C.B.D.T. in its circular dated 16-2-2018, the

controversy does not remain any longer as the matter is not res

integra any more.

- In view of the above, we are of the considered opinion that once

the Department has accepted the judgment in case of Thakker

Tobacco (supra) and has issued circular holding that assessee is

entitled to abatement of duty, in the event of closure of factory for

continuous period of 15 days or more, without first depositing the duty

in terms of Rule 10 of PMPM Rules, 2008, the appeal of the revenue

has no force and is hereby dismissed.

- The question of law is, therefore, answered in favour of the

assessee and against the revenue.”

In view of the above High Courts Judgments and observation made by

us herein above , the demand is not sustainable. Accordingly, the impugned

order is set aside. Appeal is allowed.

(Pronounced in the open court on 25.01.2023 )

RAMESH NAIR

MEMBER (JUDICIAL)

RAJU

MEMBER (TECHNICAL)