Detox Corporation Pvt Ltd VERSUS C.C.E. & S.T.-Surat-i

Customs, Excise & Service Tax

Appellate Tribunal West Zonal

Bench At Ahmedabad

REGIONAL BENCH-COURT NO. 3

Service Tax Appeal No. 14073 of 2013- DB

(Arising out of OIA-SUR-EXCUS-001-APP-339/13-14 dated 12/09/2013 passed by Commissioner of Central Excise, Customs and Service Tax-SURAT-I)

Detox Corporation Pvt Ltd

VERSUS

C.C.E. & S.T.-Surat-i

APPEARANCE:

Shri Jigar Shah, Advocate for the Appellant

Shri G.Kirupanandan, Assistant Commissioner (AR) for the Respondent

CORAM: HON’BLE MEMBER (JUDICIAL), MR. RAMESH NAIR HON’BLE MEMBER (TECHNICAL), MR. C.L.MAHAR

Final Order No. A/ 11210 /2023

RAMESH NAIR

DATE OF HEARING: 17.02.2023 DATE OF DECISION: 07.06.2023

The brief facts of the case are that during the course of service tax audit of financial records of the Appellant it was noticed that the appellant is engaged in providing services for sewage treatment to its customers/ members. The said services pertain to treatment of effluents and industrial waste generated in industrial unit, storage and disposal of industrial waste after treatment at GIDC drainage area as per criteria of Gujarat Pollution Control Board. During the treatment of such effluents/ industrial waste, no different product emerges. It was also noticed that the appellant for carrying out effluent treatment activities and disposal of industrial waste for and on behalf of customers charged amount as disposal charge from its customers. It was contended by the revenue that such services provided to customers / members for effluent treatment and disposal of waste are appropriately

classifiable under the category of service of club and association service. Accordingly, The Adjudicating Authority has confirmed the demand of Service tax and imposed penalties. Being aggrieved by the Order-In- Original, the appellant filed appeal before Commissioner (Appeals) who rejected the appeal therefore, the present appeal filed by the appellant before us.

- Shri Jigar Shah, learned Counsel appearing on behalf of the appellant submits that entire demand under club and association service was raised assuming that the appellant is the club and association and the industrialunit for which the appellant has carried out effluent treatment of waste are members of the appellant’s association . He submits that the appellant is not an association of members but it is an independent commercial company registered under Companies Act with registrar of company. The activity of effluent treatment of industrial waste is a part of their pure commercial business for the surrounding industrial units on consideration basis which is not the members’ subscription. He further submits that as in the club or association the important criteria is mutuality of interest between club and its members, in the present case the appellant and its customers are two different entity and working on purely commercial consideration, there is no mutuality of interest. Therefore, the demand under club or association service is not tenable. He further submits that by any stretch of imagination the contention of Revenue is accepted in such case also, the demand under club or association is not sustainable in light of Hon’ble Supreme Court judgment in the case of State of West Bengal vs. Calcutta Club Limited– 2019 (29) GSTL 545 (SC). He also placed reliance on the following judgment:-

- BharuchEnviro Infrastructure Ltd CCE – 2008 (7) TMI 28 – CESTAT

- GlobeEnviro Care Ltd CCE – 2010 (10) TMI 334 – CESTAT

- OdysseyOrganics Ltd Vs. CCE – 2013 (3) TMI 732 – CESTAT

- OdysseyOrganics Ltd vs. CCE – 2016 (11) TMI 584 – CESTAT

- Vippy Waste& Effluent Management Co. vs. CCE – 2012 (8) TMI 816 – CESTAT

- GloveEnviro Care Ltd CCE – 2012 (9) TMI 669 – CESTAT

- NAndesariIndustries Association CCE – 2019 (11) TMI 298 – CESTAT

- Rajasthan Co-Operative Dairy Federation Ltd Vs. CCE – 2022 (5) TMI 482 – CESTAT

-

- Shri G.Kirupanandan, Learned Assistant Commissioner (AR) appearing on behalf of theRevenue reiterates the finding of the impugned order.

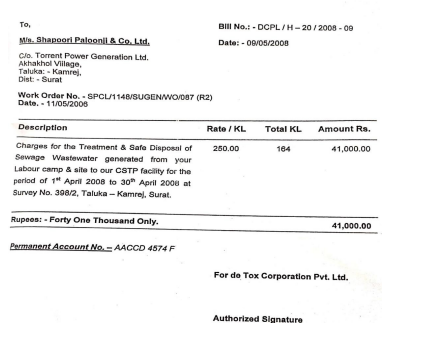

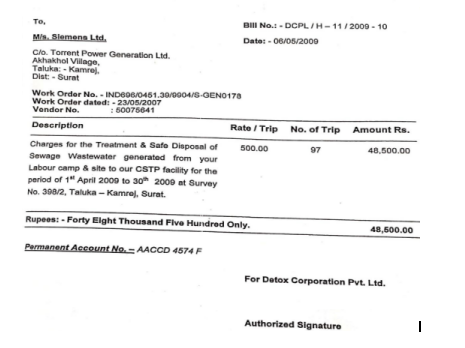

- We have carefully considered the submission made by both sides and perused the records. We find that from the facts of the case the appellant is having itsindependent processing unit for effluent treatment of industrial waste. The appellant has set up the unit with his sole capital investment. The customer for which the appellant is carrying out the effluent treatment of the waste have no legal say in the independent activity of appellant company. The appellant charge to their industrial customer for the treatment and disposal of the waste on quantitative basis. The sample invoices are scanned below :-

From the above invoice it can be seen that the appellant are carrying out activity of treatment and disposal of sewage waste water for individual customer and depending upon the quantum of waste treatment they are raising the bill and collected the charges against the same. Other then this there is no subscription involved unlike the subscription between club and association and its member. The commercial dealing between the appellant and its customer is purely on principle-to-principal basis. In case of club and associations it does not have its own importance and such club or association always a body consists of its member whereas in the present case the appellant is a business organization and its customers are not the members of such business organization. It is also fact that the dealing being on principle to principle basis there is no mutuality interest between the appellant and its customers. In view of the above fact there is no iota of doubt that there is no relationship of club and association between the appellant and its customers. Therefore, the demand raised under club or association, in our considered view cannot be sustained.

- Without prejudice to ourabove finding, we also find that even though the contention of the Revenue is accepted, the demand under club or association service shall not sustain in the light of Hon’ble Supreme Court judgment in the case of State of West Bengal vs. Calcutta Club Limited– 2019 (29) GSTL 545 (SC) wherein the Hon’ble supreme court expressed view that since there is mutuality of interest between the club or association and its members and club or association being made of its members the concept of service provider and service recipient is absent hence the service to self cannot be taxed. With this view the Apex court held that the payments received from the members of the club by club or association is not taxable for this reason also the demand is not sustainable.

- In view of our above discussion and finding the impugned order is not sustainable, hence, the same is set aside. Appeal is allowed.

(Pronounced in the open court on 07.06.2023 )

RAMESH NAIR MEMBER (JUDICIAL)

C.L MAHAR MEMBER (TECHNICAL)