Commissioner of Central Excise & ST, Vapi VERSUS Savita Oil Technologies Limited

CUSTOMS, EXCISE & SERVICE TAX

APPELLATE TRIBUNAL,

WEST ZONAL BENCH : AHMEDABAD

REGIONAL BENCH – COURT NO. 3

EXCISE Appeal No. 11190 of 2014-DB

CROSS Application No.:-E/CROSS/12859/2014

[Arising out of Order-in-Original/Appeal No VAP-EXCUS-000-COM-062-13-14 dated 27.11.2013 passed by Commissioner of Central Excise, Customs and Service Tax-VAPI]

Commissioner of Central Excise & ST, Vapi

VERSUS

Savita Oil Technologies Limited

APPEARANCE :

Shri Rajesh K Agarwal, Superintendent (AR) for the Appellant Shri Mehul Jivani, Chartered Accountant for the Respondent

CORAM: HON’BLE MR. RAMESH NAIR, MEMBER (JUDICIAL) HON’BLE MR. C.L. MAHAR, MEMBER (TECHNICAL)

DATE OF HEARING : 12.07.2023 DATE OF DECISION: 21.07.2023

FINAL ORDER NO. 11552/2023 RAMESH NAIR :

The brief facts of the case are that respondent are engaged in the manufacture of speciality and Lubricating oil. They have also premises at Navi Mumbai which is registered as ISD. The said registered ISD has distributed the credit of Rs. 6,44,65,514/- during the period June 2009 to September 2010 to the respondent. Out of the above credit, an amount of Rs. 56,94,627/- was proposed to deny for the period April 2006 to July 2009 by show cause notice dated 26.03.2011 on the ground that respondent has not produced the invoices of input service provider based on which credit was availed by ISD. The demand was confirmed by Commissioner vide order-in-original No. 24/DEM/VAPI/2011 dated 15.11.2011 on the ground that respondent did not produce the invoices issued by the service provider on the basis of which ISD has passed on the credit to the respondent. The said order was challenged before CESTAT and CESTAT has remanded the matter on the ground that appellant had clearly indicated in the reply that they have enclosed 900 copies of the invoices which are correlated with

service distributed to them by ISD and held that Adjudicating Authority should give chance to consider the issue after calling for the invoices in connection with credit distributed by the ISD and on the verification of the same view can be taken, without expressing any opinion on the merits of the case and leaving all issues open.

- In the de-novo proceedings, the respondent has submitted all the invoices except 107 invoices to the department vide letter dated09.2013. The same were verified by the jurisdictional officer. As regards the 107 invoices, the respondent accepted the demand being a small amount of Rs. 61,831/- and reversed the same in Cenvat credit register and also paid appropriate interest on the same. The aforesaid invoices were verified by the jurisdictional departmental officers. On the basis of said verification the Commissioner has dropped the demand of Rs. 56,32,796/- and confirmed the demand of Rs. 61,831/-. Being aggrieved by this de- novo order-in-original the Revenue has filed the present appeal.

- Shri Rajesh K Agarwal, learned Superintendent (AR) appearing on behalf of the Revenue reiterates of the grounds of appeal.He submits that as per the ground of appeal the learned Commissioner decided the matter only on the basis of verification report given by the jurisdictional officers. However, the eligibility of input service has not been verified therefore, the order of the Commissioner is not legal and proper and deserves to be set- aside and Revenue’s appeal be allowed.

- Shri Mehul Jivani, learned Chartered Accountant appearing on behalf of the respondent submits that learned Commissioner has dropped the demand only on the basis of detailed verification carried out by the jurisdictional officers in all respect. Therefore, the same cannot be questioned in appeal by the department. The department is not aware while filing the appeal that whether the services are eligible input services or otherwise therefore, the appeal was filed only on assumption-presumption basis whereas the learned Commissioner decided the matter after detailed verification on the directions of the Tribunal. Therefore, there was no scope for Revenue to file any

- We have carefully considered the submissions made by both the sides and perused the record.We find that Revenue has filed the appeal only on the ground that learned Commissioner has decided the matter on the basis of reports given by the jurisdictional range officer and the Commissioner has not verified the eligibility of input services. We find that this Tribunal had remanded the matter to the Adjudicating Authority with a clear direction for verification of the ISD invoices. The Adjudicating Authority has conducted the verification through the jurisdictional officers. Obviously the jurisdictional officer has verified the invoices of the service providers in detail which consists of description of the input service. Therefore, it cannot be said that the aspect of eligibility of input service has not been verified. The relevant Paras of the order-in-original are reproduced below:-

“20.3 They further submitted a letter dated 21.10.2013 wherein they informed that the C.EX. Officers conducted the verification of record during the period 11/10/2013 to 14/10/2013. They have produced all the invoices of the service providers for verification before the verifying officers. However, in respect of some cases, as the issue pertains to old period, they were unable to produce some of the invoices of the service providers as the same could not be presently traced out, the service tax credit involved on which works out Rs.61831.00 and they have already provided the relevant details to the verifying officers in the form of a statement Accordingly, they submit that they have paid off the said liability by debit entry to their cenvat credit account on 17/10/2013 vide entry no.-22. They further submit that they have already paid the interest though GAR7 for sum of 61356.00.”

“21.6 The documents i.e. bills/invoices produced by the assessee were forwarded to the jurisdictional Deputy Commissioner for necessary verification who reported vide letter F.No. V(Ch.39)3-11/Dem/2011 dated 15.10.2013 that:

“In this regard, JRO was directed to obtained invoices from the assessee and on due verification done by JRO, it has been found that some of the invoices have not been available with the assessee. The list of such invoices, which have not been made available to the office is enclosed herewith as per Annexure’A’ to the letter.”

From the said report, it is found that the jurisdictional officers have conducted verification of the ISD invoices as well as the orignal invoices issued by the service providers based on which ISD invoices have been issued to the assessee except the 107 invoices involving Cenvat Credit of service tax amounting to Rs. 61831/- which have not been produced by the assessee for verification as per Annexure A’ attached to the above letter of Deputy Commissioner of Central Excise, Division-II, Silvassa. Further, I find that the assessee have, vide letter CEX/SCN110328-EA-2000/06-10 dated 21.10.2013, submitted that they have paid/reversed the said amount of Rs. 61831/-in respect of which they could not produce the relevant invoices/bills through debit entry No. 22 dated 17.10.2013 of RG 23A Pt. II register. They have also paid interest of Rs. 61356/- applicable on the said amount of credit through GAR 7 challan dated 21.10.2013.”

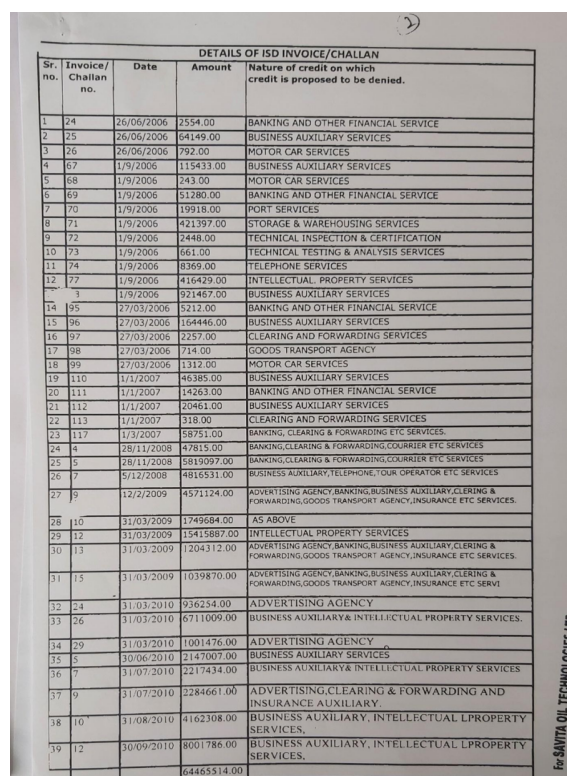

From the above facts and findings of the Adjudicating Authority in Para 20.3 and in Para 21.6, it is absolutely clear that proper verification of input services invoices has been carried out. Therefore, the ground taken in the appeal is only on assumption basis that learned Commissioner might not have verified the eligibility of input service. Moreover, the details aregiven by the appellant regarding description of service, the same is scanned below:-

- In the above chart, entire description of all the services are given which is recorded total credit of Rs. 6,44,65,514/-.On perusal of the above chart and description of services given therein, we find that all the services listed in the above chart are required in or in relation of manufacture and overall business activity of the appellant. Therefore, even on independent analysis of the services, we find that all the services are eligible input services. Therefore, we do not find any infirmity in the impugned order hence, the same is upheld. The Revenue’s appeal is dismissed. Cross objection is also disposed of.

(Pronounced in the open court on 21.07.2023)

(Ramesh Nair) Member (Judicial)

(C L Mahar) Member (Technical)

KL