Abbas Mussa Properitor VERSUS C.C.E. & S.T.-Rajkot

Customs, Excise & Service Tax

Appellate Tribunal West Zonal

Bench At Ahmedabad

REGIONAL BENCH-COURT NO. 3

Service Tax Appeal No. 10482 of 2015- DB

(Arising out of OIA-RJT-EXCUS-000-APP-239-14-15 dated 19/12/2014 passed by Commissioner of Central Excise, Customs and Service Tax-RAJKOT)

Abbas Mussa Properitor

VERSUS

C.C.E. & S.T.-Rajkot

APPEARANCE:

Shri, Ambar Kumarawt, Advocate for the Appellant

Shri Ajay Kumar Samota, Superintendent (AR) for the Respondent

CORAM: HON’BLE MEMBER (JUDICIAL), MR. RAMESH NAIR HON’BLE MEMBER (TECHNICAL), MR. C L MAHAR

Final Order No. 11658/2023

DATE OF HEARING: 21.07.2023 DATE OF DECISION: 03.08.2023

RAMESH NAIR

The briefly stated the facts of this case are that during the course of audit the audit officers observed that Shri Abbas Mussa, the appellant was providing services to M/s Senor Metals Pvt. Ltd, Jamnagar. The contention of the department is that the services provided by the appellant is classifiable under category of “Manpower Recruitment or Supply Agency Services” and the appellant failed to obtained Service Tax registration and making periodical payment of Service Tax. Accordingly, the show cause notice dated 04.04.2013 proposing demand of Service Tax amounting to Rs. 1,71,457/-, penalties and interests covering the period from October 2011 to June 2012 was issued and the same was adjudicated by the Adjudicating Authority vide

Order-in-Original dated 07.04.2014. The Adjudicating Authority vide his Order-in-Original dated 07.04.2014 dropped the proceedings. Being aggrieved by the Order-in-Original the revenue filled an appeal before the commissioner (Appeals), which was allowed by the Learned Commissioner (Appeals) except the setting aside penalty under Section 76. Being aggrieved by the said Order-in-Appeal the present appeal is filled by the appellant.

- Shri Ambar Kumarawat Learned Counsel, appearing on behalf of the appellant submits that the Adjudicating Authority has rightly dropped the demand, Consideration the fact that the appellant have not provided the service of „Manpower Recruitment and Supply Agency Services‟, whereas, the appellant have undertaken the job of unloading of scrap and sorting

- He submits that the charges for the job were also collected on per Kg basis. Therefore, the appellant have not supplied the manpower to the recipient. Whereas, they have under taken a specific job irrespective of how many manpower or man hours involved in the job. He further submits that the controls of the man power was with the appellant and not transferred to the service recipient to qualify any service as „Manpower Recruitment or Supply Agency Services‟. It is necessary that supervision the manpower which was supplied by the assessee should be of service recipient, which is not a case here. Therefore, the service is not classifiable under „manpower recruitment or supply agency services‟. He placed reliance on the following board circular and judgments:

- Circular B1/6/2005-TRU dated 27.07.2005

- Circular 96/7/2007 dated 23.08.2007

- RiteshEnterprises CCE, Bangalore 2010 (18) STR 17

- Sureel Enterprises Ltd. v. CCE & ST, Ahmedabad 2019 (10) TMI 1245

- SureelEnterprises Ltd. V. CCE & ST, Ahmedabad 2021 (5) TMI 802

- Nishkarsh Industries Services V CCE & ST, Vadodara –II 2022 (9) TMI 901

- PranavOxygen CCE & ST 2020 (1) TMI 309

- ManishEnterprises CCE, Pune-I 2016 (42) STR 352

- NizamSugar Factory CCE & ST, AP 2006 (197) ELT 465

- Shree Ajay Kumar Samota Learned Superintendent (AR) appearing on behalf of the Revenue reiterates the finding of the impugned order.

- We have carefully considered the submission made by both the sides and perused the records. We find that in the present case the revenue sought to classify, the activity ofthe appellant under „Manpower Recruitment or Supply Agency Services‟, which is defined as under:

[(68) “manpower recruitment or supply agency” means any “[person] engaged in pro- viding any service, directly or indirectly, in any manner for recruitment or sup- ply of manpower, temporarily or otherwise, to a client;]

- In the above definition, it is clear that only in case where an assessee provides the manpower to the service recipient and the service recipient himself get the required job done from such manpower, under his supervision and the service charge paid by the service recipient on the basis of number of manpower, man hours to the service provider, then only such activity can be categorized under „Manpower Recruitment or Supply Agency

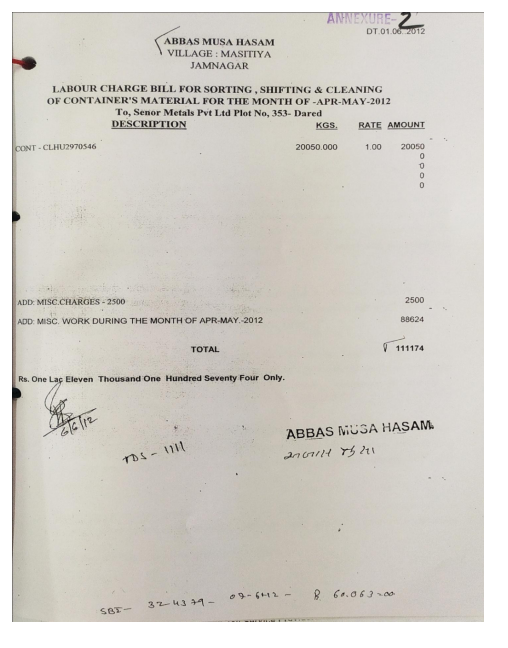

Services‟. To understand the fact in the present case it is necessary to ascertain the payment terms, for which a sample copy of the invoice raised by the appellant to the service recipient is scanned below:

- From the above invoice it can be seen that the job under taken by the appellantis sorting, shifting and cleaning of container‟s materials and the

charges for the same was claimed 1 rupee per kg basis. This clearly shows that the service recipient is not concern about the number of manpower deputed for the job, whereas the service recipient has assigned the job to the appellant only in respect of sorting, shifting and cleaning of container‟s materials. The control of the manpower in this fact is obviously with the appellant and not with the service recipient.

- In this fact it is clear that the appellant have not provided the services of„Manpower Supply or Recruitment Agency Services‟, this fact of the case is not under dispute as on this basis only the Adjudicating Authority has dropped the proceeding initiated in the show cause notice. This issue has come up time and again before this Tribunal. This Tribunal in the case of Ritesh Enterprises has taken the following view:

- We have considered the submissions made at length by both sides and perused the records. The question that arises for consideration is whether the services rendered by the appellants are classifiable under the heading “manpower recruitment & supply agency”?

- The definition of the manpower recruitment or supply agency under Section 65(105) reads as under :-

“any commercial concern engaged in providing any service, directly or indirectly, in any manner for recruitment or supply of manpower, temporarily or otherwise, to a client.”

The taxable service liable for Service tax is also defined under Section 65(105)(K) which is as under :

“any service provided to a client, by a manpower recruitment or supply agency in relation to the recruitment or supply of manpower, temporarily or otherwise, in any manner.”

From the plain reading of the above reproduced definitions in the Finance Act, 1994, we find that the activity should be providing of any service directly or indirectly in any manner for recruitment or supply of man-power temporarily or otherwise to a client in order to get covered under the said definition. There should be either a recruitment or supply of manpower temporarily or otherwise.

We find from the records that M/s. Aspin Wall & Co. had given the contract as under

:

“Work Order No. 005/RE/2004-05 dated 20-11-2004 M/s. Ritesh Enterprises,

Vjaya Mahal

Surathkal 594158. Dear Sir,

Godown handling operation at our Bagging Plant, Maroli

We refer to work order of even number dated 20-11-2003 and further Discussions had with you on the handling of bulk bagged fertilizers in our Bagging Plant. We have pleasure in awarding you the handling job for a period of further two years as per the following rates, terms and conditions :

Inside the Plant :-

| Feeding bags for

filling bulk, stitching shifting bagged cargo and Stacking |

Rs. 13.75

per mt |

| De stacking and

loading bagged cargo on to long trucks |

Rs.

06.00 per mt |

| De stacking and

loading onto trucks for wagon loading |

Rs.

09.00 per mt |

| High stacking

above 15 tier |

Rs.

03.00 per mt |

| Employment of

casuals for tipper cleaning, and in the plant, Providing shovels buckets etc |

Rs.

03.00 per mt |

| Service charges | Rs.

03.50 per mt |

Side godowns :

| Unloading and

stacking wagon cargo |

Rs.

12.75 per mt |

| Dc stacking and

loading |

Rs.

10.00 per mt |

| Re standardization

of c/t bags |

Rs.

25.00 per mt |

| Casuals for | Rs. |

| sweeping

collection |

00.50

per mt |

| Service Charges | Rs.

03.00 per mt |

Gunny handling

| Unloading HDPE

Bales |

Rs.

04.00 per bale |

| Reloading of HDPE

ales |

Rs.

04.00 per bale |

- The rates given above shall be firm without any escalation during the tenure of this work order. However the company reserves its right to extend the samefor further period on mutual agreement.”

- The company is at liberty to enter into parallel contract with any other party, if required.

- The overall interest of the company should be safeguarded by you and loss/damage to the company due to your negligence/fault shall be recovered from you.

- Proper accounts of the cargo/empty bags shall have to be furnished to us on completion of each operations.

- You have to arrange round the clock work in the Plant and keep in touch with our officials, supervisors for better coordination in arrival of bulk prompt standardization etc.,

- The labour utilized by you for the handling operations under this work order shall be treated as your employees and the company shall have no responsibility whatsoever in this regard. You shall comply with all statutory requirements, government regulations etc. and shall fully indemnify the company against any claims arising as a result of your failure to comply with such formalities.

- Only 90% of the charges at the maximum will be paid to you for the completed work on weekly basis. The balance shall be released on satisfactory completion of the work shipwise/commodity wise and on your submitting the relevant bills. The company shall deduct 5% from your bills towards security deposit and the same shall be kept in your running account till a total security of

1.5 lakhs is maintained.

- The Company reserves its right to terminate this work order withoutassigning any reason by giving you one week’s notice.

Please sign and return duplicate copy of this work order as a token of your acceptance of the rates terms and conditions mentioned hereinabove.”

Contract awarded by Central Warehousing Corporation is as under : “No. H-700 (22) MLR-RI/2005/6473

Date 28-12-2004

M/s. Ritesh Enterprises

Vijay Mahal, Suratkal-574158.

Sub : Appointment of H&T contract on adhoc basis at CW. Mangalore – Reg.

Ref: 1. Tender No CWC/BLR/H-700(22)/04 dated 7-10-2004

- Telegramdated27-12-2004.

Sir,

Please refer to your tender referred above submitted and opened on 18-10-2004 and negotiations had on 23-12-2004 at this office for adhoc handling and transport contract at Central Warehouse, Mannangudda, Mangalore.

We are pleased to award the contract at the above centre with effect from 1-1- 2005 for a period of 3 (three) months with a provision to extend for a further period of three months at the following negotiated rate :-

- Handling Services, Above Schedule of Rates (Appendix VI) : 162% (one hundred sixty-two percent);

- Transportation to and from goodshed to Warehouse and vice versa: Rs. 54/- (Rupees fifty four only) per MT ONLY ON POINT TO POINT BASIS.

- Internal Transportation : Rs. 20/- (rupees twenty only) per MT only on pointto point Basis.

You are advised to comply with the following requirements by 31-12-2004 :-

- Execute an agreement on a stamp paper of appropriate value but not less than Rs. 100/- as per the latest stipulation of Government of Karnataka along with two witnesses to the agreement.

- The Security Deposit of Rs. 60,000/- (Rupees sixty thousand only) in the form of Demand Draft.

- Obtainthe license under Contract Labour (R&A) Act, 1970 from the concerned

– RLC(C)/ALC(C) in case 20 or more labourers are engaged on any day during the tenure of the contract.”

- As regards the works executed bythe appellant M/s. Karwar Dock & Port Labour Cooperative Society Ltd., we find from the records and the documents produced before us that they were intimated about the berthing of vessels at various ports and they were given a lump sum contract for cargo handling e. loading and unloading of the goods into the said vessels. We perused the invoices issued by the appellant M/s. Karwar Dock & Port Labour Cooperative Society Ltd., which is annexed at Page Nos. 170 and 171 of the appeal memoranda and noted that the invoices are raised as “cargo handling for granite export loading of Indian rough granite blocks” for a lump sum amount, charged per Metric Tonne.

- On a careful consideration of the above reproduced facts from the entire case papers, we find that the contract which has been given to the appellants is for the execution of thework of loading, unloading, bagging, stacking destacking etc., In the entire records, we find that there is no whisper of supply manpower to the said M/s. Aspin Wall & Co. or to CWC or any other recipient of the services in both these appeals. As can be seen from the reproduced contracts and the invoices issued by the appellants that the entire essence of the contract was an execution of work as understood by the appellant and the recipient of the services. We find that the Hon’ble Supreme Court in the case of Super Poly Fabriks Ltd. CCE, Punjab (supra) in paragraph 8 has specifically laid down the ratio which is as under :

“There cannot be any doubt whatsoever that a document has to be read as a whole. The purport and object with which the parties thereto entered into a contract ought to be ascertained only from the terms and conditions thereof. Neither the nomenclature of the document nor any particular activity undertaken by the parties to the contract would be decisive.”

An identical view was taken up by Hon’ble Supreme Court in the case of State of A.P.

- Kone Elevators India Ltd. (supra) and UOI v. Mahindra and Mahindra in a similar issues. The ratio of all the three judgments of the Hon’ble Supreme Court, is that the tenorof agreement betweenthe parties has to be understood and interpreted on the basis that the said agreement reflected the role of parties. The said ratio applies to the current cases in hand. We find that the entire tenor of the agreement and the purchase orders issued by the appellants’ service recipient clearly indicates the execution of a lump-sum work. In our opinion this lump-sum work would not fall under the category of providing of service of supply of manpower temporarily or otherwise either directly or indirectly.

- On perusal of the records and the submissions of learned SDR on the Master Circulardated 23-8-2007, we find that the issue is raised at clause 02 is as under:

| Business or industrial organizations engage services of manpower recruitment or supply agencies for temporary supply of manpower which is engaged for a specified period or for completion of particular projects or tasks.

Whether Service tax is liable on such services under manpower recruitment or supply agency’s services? |

In the case of supply of manpower individuals are contractually employed by the manpower recruitment or supply agency. The agency agrees for use for the services of an individual, employed by him to another person for a consideration.

Employer-employee relationship in such case exists between the agency and the individual and not between the individual and the person who uses the services of the individual.

Such cases are covered within the scope of the definition of the taxable service Section 65(105)(k) and, since they act as supply agency, they fall within the definition of “manpower recruitment or supply agency” Section 65(68) and are liable to service tax. |

- It can be seen from the above reproduced portion of the Master Circular that it is in respect of supply of manpower which is engaged for specified period or for completion of particular projects or tasks. The clarification, is in case of supply ofman power, it can be seen that the clarification specifically reads that the agency agrees for use of services of an individual to another person for a consideration as supply of manpower. In the cases in hand, there is no agreement for utilization of services of an individual but a job/lump-sum work given to the appellants for execution. The said clarification issued by the Board would be appropriate in the case where services of man power recruitment & supply agency, had been temporarily taken by the Business or the industrial association for supplying of manpower and may/may not be for execution of a specific work. We are of the considered view that the reliance placed by the learned SDR and the learned Commissioner on the circular will not carry the case of the Revenue any further.

- Accordingly inview of the above findings, we are of the view that the impugned orders are liable to be set aside and we do so. The appeals are allowed with consequential relief if any. Since we have disposed of the appeals on merits itself, no findings are recorded on other submissions made by both sides in these appeals.

- Inthe similar case of Sureel Enterprises Limited (Supra) the Tribunal has passed the following order:

“5. We find that very identical issue in the appellant’s own case for the previous period

i.e. June 2005 to June 2010 was considered by this Tribunal in Service Tax Appeal Nos. 2327 of 2011, 768 of 2011 and 10391 of 2013.In these appeals this Tribunal has passed a Final Order No. A/11947-11949/2019 dated 18.10.2019 whereby it was held that the appellant’s activities amount to manufacture and does not amount to service of Manpower Recruitment Agency Service. Accordingly, the appeals were allowed. This Tribunal following various judgment namely, Ramesh C. Patel 2012 (25) STR 471 (Tri. Amd.), Jubilant Industries Limited 2013 (31) STR 181 (Tri. Del.) and Shiv Narayan Bansal 2013 (31) STR 747 held that contract between the appellant and M/s Nirma Limited is of contract manufacturing hence demand under manpower supply cannot be made. Concluding and operating portion of the order is reproduced below:

From the above judgments the issue in hand is settled that when the contract between the service provider and service recipient is admittedly of contract manufacturing in such case demarid under man power supply cannot be made. The appellant have vehemently argued on Revenue neutral situation on the ground that if at all the appellant is liable to pay service tax the same is available as cenvat credit to the service recipient i.e. M/s. Nirma Ltd. In this regard, he also submitted the details of payment of excise duty of M/s. Nirma Ltd from PLA/cash. This prima facie show that it is a case of Revenue neutral and by not paying the service tax by the appellant the Government Exchequer is not at any loss, however, since, we have already decided the issue on merit, we are not giving our concluding opinion on Revenue Neutral position. The issue of jurisdiction raised by the appellant is also kept open.

As per our above discussion the impugned order is not sustainable. Hence, the same is set aside. The appeals are allowed with consequential relief, if any, in accordance with law.

- In view of above decision of the Tribunal in the appellant’s own case on the same issue, the issue in the present case is no longer res integra. The only difference in the present case and the case decided supra is the difference of period. However, there is no change in the facts and the law point, therefore, the Tribunal’s decision given by Order dated 18.10.2019 is squarely applicable in the present case. Accordingly, the impugned orders are set aside. The appeals are allowed.”

- Same view was expressed by this Tribunal in another case ofNishkarsh Industrial Services, wherein this Tribunal has passed the following order:

“4. We have carefully considered the submissions made by both the sides and perused the record. We find that in the present dispute whether the service is of Manpower Recruitment or Supply Agency Service or job work can be decided only on the basis of the agreement entered between service provider and service recipient. As per the agreement in the present case, the service recipient is having their factory and carried out various manufacturing activities. The present appellant was assigned job work related to manufacturing on the basis of charges which is per piece basis and the item being manufactured by the appellant. As per terms and conditions of the agreement, the service recipient will provide all the facilities such as machines, tools, place etc. The appellant has only to undertake work done their skilled, semi- skilled, non-skilled workers as per drawing by appointing workers/contractor. It is also one of the conditions that the appellant is under obligation to pay minimum wages to its workers even though there is no work. However, whenever there is work, the charges will be paid by the service recipient to the appellant as per the rates decided i.e. per piece basis.

- As regards the responsibility and control, it is the appellant who has to bearall the responsibility of appointed workers according to the labour laws. With the aforesaid terms and conditions, it is clear that the appellant is carrying out the job work relating to manufacturing as per agreement entered with the facilities provided by the service recipient and the charges is also per piece basis. The entire control of workers deputed by the appellant for the job work is with the appellant only and the service recipient has no obligation as regards the number of workers, man-hour etc. for the job assigned to the appellant. In these terms of contract, we are of the clear view that contract is for job work carried out by the appellant for the service recipient. Therefore, there is no activity of providing the service of Manpower Recruitment or Supply Agency Service. The judgment relied upon by the appellant are directly on the issue. In the case of Sureel Enterprise Pvt. Limited vs. CCE & ST., Ahmedabad 2019 (10) TMI 1245-CESTAT Ahmedabad wherein the similar facts are prevailing inasmuch as the service provider provided the”

4.6 In view of the above decisions on the identical issue in hand and our observation made herein above, we are of the clear view that the appellant

have not provided the „Manpower Recruitment or Supply Agency Services‟. Therefore, the demand made under the said category is not sustainable.

- Accordingly, we set aside the impugned order, uphold the Order-in- Original and allow the appeal filed by the appellant.

(Pronounced in the open court on 03.08.2023 )

(RAMESH NAIR) MEMBER (JUDICIAL)

(C L MAHAR) MEMBER (TECHNICAL)