Adani Wilmar Ltd VERSUS C.C.E. & S.T.-Ahmedabad-iii

Excise Appeal No.11584 of 2013

(Arising out of OIA-46-2013-AHD-III-SKS-COMMR-A-AHD dated 15/03/2013 passed by

Commissioner of Central Excise-AHMEDABAD-III)

Adani Wilmar Ltd

VERSUS

C.C.E. & S.T.-Ahmedabad-iii

APPEARANCE:

Shri S J Vyas, Advocate for the Appellant

Shri Prakash Kumar Singh, Superintendent (AR) for the Respondent

CORAM: HON’BLE MEMBER (JUDICIAL), MR. RAMESH NAIR

HON’BLE MEMBER (TECHNICAL), MR. RAJU

Final Order No. A/ 10237 /2023

DATE OF HEARING: 27.01.2023

DATE OF DECISION: 07.02.2023

RAMESH NAIR

The issue involved in the present case is that whether the appellant is

liable to pay excise duty on spent earth arising out of the refined vegetable

oil.

- Shri S J Vyas, learned counsel appearing on behalf of the appellant

submits that the very same issue has been settled by CESTAT- Hyderabad in

the case of M/s. PRIYANKA REFINERIES PVT LTD UNIT II- 2019 (7) TMI 249.

He also placed reliance on the decision in the case of M/S. RICELA HEALTH

FOODS LTD., M/S. J.V.L. AGRO INDUSTRIAL LTD., M/S. KISSAN FATS

LIMITED- 2018 (2) TMI 1395-CESTAT NEW DELHI.

- Shri Prakash Kumar Singh, learned Superintendent (AR) appearing on

behalf of the revenue reiterates the finding of the impugned order.

- We have carefully considered the submissions made by both the sides

and perused the records. We find that the issue to be decided is that during

the course of manufacture of vegetable refined oil which is exempted, the

emergence of spent earth is liable to excise duty or otherwise. We find that

the very same issue has been considered by this tribunal in the case of M/s.

PRIYANKA REFINERIES PVT LTD UNIT II (supra) wherein, the tribunal has

passed the following order:-

- We have considered the arguments on both sides and find that the

issue in hand is identical to the issue before the Larger Bench of the

Tribunal in the case of Ricela Health Foods Ltd (supra). The short point

to be decided is whether the fatty acids/ wax/ gums, etc., which arise

while crude vegetable oil is refined should be considered as waste or as

by- product. If these are considered as waste, they are covered by

exemption notification 89/1995-CE. If, on the other hand, these are

considered as by-products, as asserted by the department, they are not

entitled to the benefit of this notification. The matter has been decided

by the Larger Bench of the Tribunal in Ricela Health Foods (supra) and

it has been held that these products are not intentionally manufactured

but only arise during the process of refining of crude vegetable oil and

therefore should be considered as waste and they are entitled to the

benefit of exemption notification 89/1995-CE. Respectfully following the

decision of the Larger Bench, we hold that the impugned order is

unsustainable and liable to be set aside and we do so.

- The appeal is allowed and the impugned order is set aside.

The same issue has been considered by CESTAT- New Delhi in the case of

M/S. RICELA HEALTH FOODS LTD., M/S. J.V.L. AGRO INDUSTRIAL LTD.,

M/S. KISSAN FATS LIMITED (supra) wherein, the tribunal has observed as

under:-

- We have heard the learned counsels for the appellants. The learned

counsels submitted on the process undertaken by the appellants

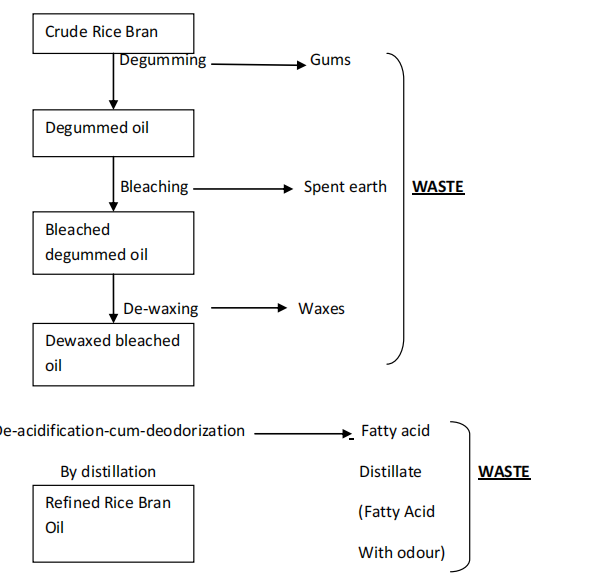

starting from the receipt of crude rice bran oil. The following flow chart

was presented to explain the process:-

The learned Counsel mainly submitted on the following lines:-

(a) the products, in question, are essentially inevitable waste, which

the appellant never intended to manufacture and, as such, cannotbe

considered as a result of manufacturing process;

(b) without prejudice to the above, the products, in question, are

clearly exempted under Notification 89/95- CE. The Revenue itself

contends that wax, fatty acid and gums are waste arising during the

course of refining of vegetable oil;

(c) no reliance can be placed on the order of the Tribunal in A.G. Fats

(supra) as the same is devoid of legal basis and is incorrect in law. The

said decision departed from many rulings of the Tribunal earlier. The

reference made by the Tribunal in A.G. Fats (supra) to the decision of

CCE, Hyderabad vs. Priyanka Refineries Ltd. – 2010 (249) E.L.T. 70

(Tri. Bang.) is factually incorrect. The said decision of the Tribunal in

Priyanka Refineries (supra) has been affirmed by the Apex court by

dismissing the civil appeal Nos. 219-220 of 2010 filed by the Revenue

reported in 2011 (274) E.L.T. A16 (S.C.). This was wrongly referred to

as dismissal of SLP. The Tribunal noted the dismissal of civil appeal by

the Apex court incorrectly as dismissal of SLP;

(d) the order of the Hon’ble Supreme Court affirming the decision of

the Tribunal in A.G. Fats (supra) by dismissing the civil appeal will not

form a binding precedent in view of similar dismissal of civil appeal

against a contrary decision in Priyanka Refineries (supra). Thus, there

exist two decisions of co-equal Benches on the same Issue. The Larger

Bench of the Tribunal, now seized of the matter, should take a view

which correctly reflects the legal position. Reliance was placed on the

decision of Hon’ble Calcutta High Court In New India Assurance Co. Ltd.

– AIR 2004 CAL 1.

- The learned Counsel reiterated that the Larger Bench is deciding

only on the reference made by the Excise Division Bench and, as such,

the other connected disputes with reference to classification, valuation,

Cenvat credit, penalty etc. would have to be decided by the appropriate

Division Bench after the decision of the Larger Bench on the referred

dispute.

- The learned AR submitted that waste and by-product have

different scope and meaning. There is a clear distinction between these

two. By- products emerge as unavoidable outcome of a manufacturing

process and do have significant commercial value. Waste on the other

hand is such type of by-product which is generally in the nature of

rejects or refuse, fit to be discarded. They have little or no commercial

importance. All products emerging during the course of main final

products cannot be considered as waste, eligible for exemption under

the said notification.

- We have heard both the sides and perused the appeal record to

examine the reference made by the Division Bench. Since the

appellants submitted on the excisability itself the first point for decision

is the excisability of the products, in question. The appellants strongly

contended that even before examining the admissibility of exemption

under Notification 89/1995-CE, the point to be decided is the

excisability of the product, in question. It is the case of the appellant

that if it can be established that these goods are not manufactured

goods then the question of levy itself will not arise. It is contended that

the product, in question, are unwanted/inevitable waste. The value

realized by the appellants on such unintended waste by sale, itself is

not a criteria to decide the excisability. The Hon’ble Supreme Court in

CCE vs. Indian Aluminium Company 2006 (203) E.L.T. 3 (S.C.) held

zinc dross and flux skimming are not eligible to central excise duty.

Relying on the earlier decisions in Union of India vs. Indian Aluminium

Company Ltd. 1995 (77) E.L.T. 268 (S.C.) and CCE, Patna vs. Tata Iron

& Steel Company Ltd.. – 2004 (165) E.L.T. 386 (S.C.), the Apex court

held that the dross and skimming arising during the course of

manufacture of metal cannot be subjected to excise levy only because

it may have some saleable value, observing that the term “manufacture

implies a change; every change, however, is not a manufacture”. Every

change of an article may be the result of treatment, labour and

manipulation. The manufacture would Imply something more. There

must be a transformation; a new and different article must emerge

having a descriptive name, character or use (Delhi Cloth and General

Mills Company Ltd. – AIR 63 SC 791). The Apex court categorically held

that dross do not answers the description of “waste and scrap”.

- In view of the ratio adopted by the Apex court while arriving at the

above decisions, the point for consideration in the present dispute is

the gums, waxes and fatty acid that emerge as a by-product can be

considered as a products arising out of a manufacturing process. The

appellants are engaged in converting crude rice bran oil into refined rice

bran oil. In effect the processes undertaken by them are towards this

intended final product. For producing refined rice bran oll, the gums

and waxes available in the crude rice bran oil are to be removed by

deguming and de-waxing. Thereafter by a process of deacidification/

de- odourisation, by distillation the refined oil is obtained. In this final

process fatty acid distillate (fatty acid with odour) is obtained as a

waste. As can be seen the gums, waxes and fatty acid distillate are

emerging due to removal/refining process of crude rice bran oil. As

already noted the process is to obtain refined rice bran oil by removing

these unwanted products alongwith spent earth, which when present

makes the oil as crude refined oil.

- The thrust of the arguments by the Revenue is that when a

product is capable of being sold for a significant consideration the same

cannot be considered as waste. We are unable to accept such summary

presumption. Admittedly, in chemical and metallurgical industry when

the raw materials are processed with an intended purpose of

manufacturing certain final products by a chemical reaction, refining,

melting etc. multiple products will result. These products either

emerged in the final stage or any of the intermediating stages also. The

point for consideration is whether these are to be considered as

manufactured goods for excise levy based on the statutory definition

for manufacture or should be considered as manufactured goods based

on the likely value they may command while selling. We are clear that

the value that a product may or may not fetch cannot be a

determinative factor to decide whether the same is a manufactured

final product/by product or a waste/refuse arising during the course of

manufacture of final products. This much is clear from the ratio of the

Apex court decision in Indian Aluminium Co. (supra). While no general

guidelines can be laid down to decide when a product will be treated as

a waste or a by product, in the present set of facts the products under

consideration are clearly not in the nature of by products emerging

during the course of manufacture. The process of manufacturing refined

vegetable oil is essentially by removing the unwanted materials that

were present in the crude vegetable oil so that a refined vegetable oil

can be obtained. In this process of refining, the unwanted materials are

removed. Hence, we are of the considered view that the removal of

unwanted materials resulting in products like gums, waxes and fatty

acid with odour cannot be called as a process of manufacture of these

gums, waxes and fatty acid with odour. The process of manufacture is

for refined rice bran oil. As such, we note that these Incidental products

are nothing but waste arising during course of refining of rice bran oil

and applying the ratio of Apex court, as discussed above, these cannot

be considered as manufactured excisable goods. Noting that the

reference is to decide whether these are to be treated as waste for the

purpose of exemption Notification 89/95-CE we note though the

excisability of the product itself is seriously in dispute as per the

opinion expressed by us, as above, these cannot be considered as

anything other than waste and as such will be covered by the

exemption Notification No. 89/95-CE. This has been pleaded as a

alternate argument by the appellant/assessee also.

- As such in view of the above discussion and finding, we note that

the appellant/assessee are eligible for exemption under the said

notification.

- The appeal files are returned, with the above findings, to the

regular Division Bench for decision on the points raised in the

respective appeals.

- In view of the above judgment which are on the identical issue and on

the same product, the issue is no longer res-integra accordingly, the

impugned order is set aside. Appeal is allowed.

(Pronounced in the open court on 07.02.2023)

(RAMESH NAIR)

MEMBER (JUDICIAL)

(RAJU)

MEMBER (TECHNICAL)