BLUE BIRD CARGO PVT LTD VERSUS C.C.,-KANDLA

Customs, Excise & Service Tax Appellate

Tribunal West Zonal Bench At Ahmedabad

REGIONAL BENCH- COURT NO. 1

CUSTOMS Appeal No. 12456 of 2013-DB

(Arising out of OIO-KDL/COMMMR/01/2013-14 Dated-15.04.2013 passed by Commissioner of Customs –KANDLA)

BLUE BIRD CARGO PVT LTD

VERSUS

C.C.,-KANDLA

WITH

CUSTOMS Appeal No. 12457 of 2013-DB

(Arising out of OIO-KDL/COMMMR/01/2013-14 Dated-15.04.2013 passed by Commissioner of Customs –KANDLA)

DHEERAJ NARAYAN TEWARI APPELLANT

ASSISTANT MANAGER, 1415, ANSAL TOWERS,

38, NEHRU PLACE, NEW DELHI

VERSUS

C.C.,-KANDLA RESPONDENT

CUSTOM HOUSE, NEAR BALAJI TEMPLE, KANDLA-GUJARAT

APPEARANCE:

Ms. Shikha Sapra, Reena Rawat, Advocates appeared for the Appellant

Mr. Sanjay Kumar, Superintendent (Authorized Representative) for the Respondent

CORAM: HON’BLE MR. RAJU, MEMBER (TECHNICAL) HON’BLE MR. SOMESH ARORA (JUDICIAL)

Final Order No. A/ 10961-10962 /2023

SOMESH ARORA

DATE OF HEARING:25.04.2023 DATE OF DECISION:25.04.2023

Both the appeals arise from a common Order-in-Original No. KDL- COMMR-01-2013-14 passed by Commissioner of Customs, Kandla. In this matter under the guise of machine parts Red Sander Logs were attempted to be exported, the same were intercepted by the Customs and investigations conducted. It was revealed that the main accused

were still at large when the Show Cause Notice was issued. Department on the basis of statements of available persons alleged involvement in various roles and export documentation and issued SCN. Same were adjudicated by the Commissioner who dropped the proceedings against M/s Container Corp. of India, which was the lending agency for the empty containers. The appellants before us i.e. M/s Blue Bird Cargo Pvt. Ltd. was providing containers further to various exporters through CHA on the shipping line. The other appellant M/s Dheeraj Narayan Tewari was an employee of M/s Blue Bird Cargo Private Limited and dealt with the documentation in the instant case in that company.

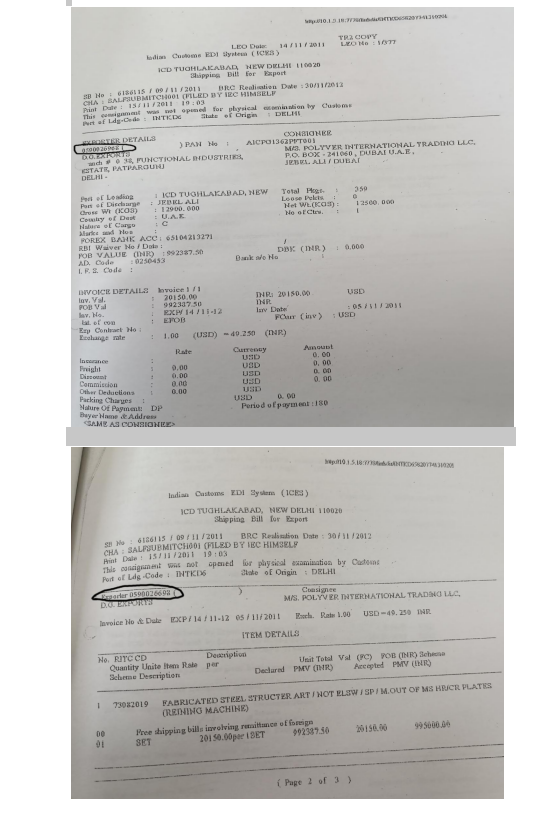

- When the matter was called, learned Authorized Representative initially brought to our notice that it was a case where forged shipping bills were used and In House Bill of Lading was issued by the appellant company.On the other hand, the main thrust of the defense of the appellant was that no knowledge had been attributed to them and there is also no testimonial evidence that they had knowledge about what was contained in the cargo which was in a sealed container and was attempted to be exported by the proprietor of M/s DG Exports, who is at large. Regarding the point of forgery having taken place in the shipping bills which are at running page 90 and 91 in the file of M/s Blue Bird Cargo Private Limited, they stated that it could have been overlooked by the person making in-house bill of lading, as it had to deal with number of documents. Actus Reus (Guilty Act) cannot be proved on the basis of possibilities or suspicion alone. The relevant document referred by both the sides at R/f 90 and 91 are as follows:

It was also pointed out by them that no such charge was levied against them and they were not even put to questioning by the investigating authority and were denied opportunity to explain regarding discrepancies found in the shipping bills and which are not part of proceedings before us as far as charge against them is concerned. Accordingly they could not give the defense on the proposition of the learned Authorized Representative that forgery/discrepancy was such, which could have been normally detected with IEC Code being different in two pages. The learned authorized representative on the other hand also emphasized that this being the situation and the bill of lading having been issued on the basis of the forged document, it was suspected that their involvement was there, and therefore, the penalty was rightly imposed under Section 114 AA and 114(i).

- We have gone through the case records as well as adversarial submissions.We find that the main accused were still at large and the show cause notice issued to the accused, who were available. Who did the forgery is not available from records. From whatever evidences are available, including the testimonial evidence, it is clear that there is nothing on record to show knowledge of the present appellants about the offending goods being present in the container which were arranged through them. Also as far as forgery is concerned, we are unable at this stage to agree with the proposition of the authorized representative that it was suspicious circumstances and should have raised degree of alarm in both the appellants to discharge their duty properly. We find that Section 114AA and 114(i) had an inbuilt clause requiring knowledge in relation to the offending goods being present and not merely suspicious Actus reus, where required cannot be proved by lack of diligence alone, at least for penalties under Sections

invoked. Even though the discrepancies which have been brought on record indicate that underlying shipping bills were tempered with. We find that there is no questioning done or evidence brought on record by the department to support the argument of the authorized representative. Therefore, at this stage and with the evidence which have been brought on record, we are not able to agree with proposition of learned authorized representative that knowledge could have been there. It is not the possibility but the definite knowledge through some evidence, which is required to be brought on record for the above penal provisions. There is failure on this account by the department. Accordingly, we allow the appeals with consequential relief as far as these two appellants are concerned.

(Dictated and Pronounced in the open court)

(RAJU) MEMBER (TECHNICAL)

(SOMESH ARORA) MEMBER (JUDICIAL)