Stelmec Ltd VERSUS C.S.T.-Service Tax – Ahmedabad

Service Tax Appeal No. 131 of 2012

(Arising out of OIO-STC/51/COMMR/AHD/2011 dated- 28/11/2011 passed by Commissioner

of Service Tax-SERVICE TAX – AHMEDABAD)

Stelmec Ltd

VERSUS

C.S.T.-Service Tax – Ahmedabad

Appearance:

Shri H.G Dharmadhikari & Shri D. A Bhalerao, Advocates appeared for the

Appellant

Shri Vinod Lukose, Superintendent (AR) for the Respondent

CORAM:

HON’BLE MEMBER (JUDICIAL), MR. RAMESH NAIR

HON’BLE MEMBER (TECHNICAL), MR. RAJU

Final Order No. A / 10043 /2023

DATE OF HEARING: 15.09.2022

DATE OF DECISION:12.01.2023

RAJU

This appeal has been filed by M/s Stelmec against demand of service

tax and denial of cenvat credit.

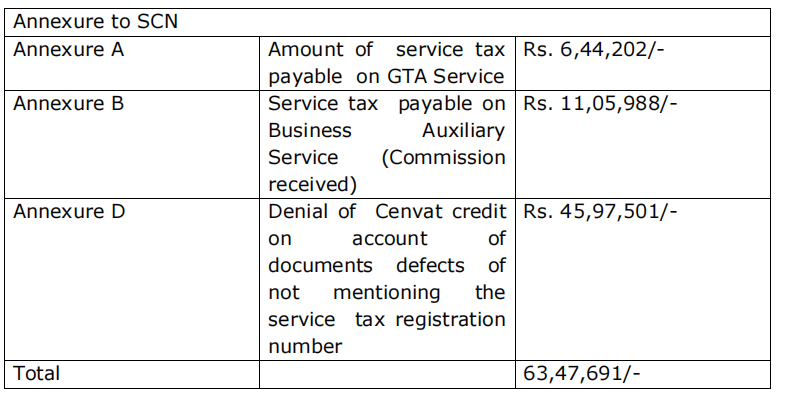

Learned counsel pointed out that following demand has been

confirmed against the appellant.

Learned counsel pointed out that the demand of service tax on GTA

services is raised on the basis of the figures reported in the ST-3 return and

figures appearing in the balance sheet/P&L Account of the appellant. Learned

counsel argued that the demand is based on the assumption and

presumptions. He also pointed out that they have submitted reconciliation in

the shape of a certificate of chartered accountant which has been summarily

rejected. Learned counsel also pointed out that demand has also been made

in respect of amount reflected in the Balance Sheet for which no payment

had been made at the material time. He pointed out that the service tax

liability arises only at the time of receipt of payment. He further pointed out

that in para 8.1.4 the adjudicating authority has admitted that part of the

liability would arise after 31.03.2008 but has confirmed the demand stating

that no evidence of payment of service tax for the period after 31.03.2008

has been made by the appellant. Learned counsel also pointed out that the

issue is revenue neutral as the appellant would be entitled to cenvat credit

of the duty service tax paid.

3.1 Learned AR relies on the impugned order. He pointed out that no

evidence of payment of service tax on GTA service has been produced by

the appellant.

3.2 On the issue of the demand of service tax on the GTA service, it is

noticed that the demand has been made on the basis of difference between

the figures appearing in ST-3 Return and balance sheet/P&L account. From

the order it is noticed that the adjudicating authority has rejected the CA

Certificate for the reason that the supporting document has not been given

by the appellant. The purpose of getting the service from the CA is that a

summary of the findings can be obtained. In case the adjudicating

authority had any doubt regarding the CA certificate he could have asked for

the supporting document or any other explanation. We find that no such

documents have been sought by the adjudicating authority. In these

circumstances summary rejection of chartered accountant certificate is not

right. Learned counsel argued that the situation is revenue neutral as the

appellant would have been entitled to cenvat credit on the tax paid on the

GTA services. It is not entirely correct argument as part of the GTA services

could have been availed for the purpose of clearance of finished goods and

the admissibility of cenvat credit on such service tax depends on many

factors. In this circumstance the argument of revenue neutrality does not

survive.

3.3 In view of the above the order confirming demand on service tax on

GTA services is set aside and the matter is remanded back to the Original

Adjudicating Authority to decide a fresh. The doubt raised on the CA

certificate may be highlighted and if the necessary supporting need

document can be called.

Learned counsel pointed out that the demand of service tax has been

made under the category of Business Auxiliary service on the commission

received by the appellant. Learned counsel pointed out that they have

discharged the necessary service tax liability on the said commission

and the detailed reconciliation of the said payment was given to the

auditors vide their letter dated 26.03.2009. Learned counsel pointed out

that the amount of 1, 11, 32,454/- was an amount receivable in their

account under the head of commission as on 01.04.2004 for the

services provided prior to that date. It has been argued at that material time

when the service tax was provided the same was exempt under Notification

No. 13/2003–ST dated 20.06.2003 Learned counsel stated that they have

submitted a certificate dated 10.09.2011 from Chartered Accountant to

support their contention that the amount of which demand has been raised

was in respect of the services provided prior to 01.04.2004. Learned counsel

pointed out that the exemption under Notification No. 13/03- ST dated

20.06.2003 has been denied by the Adjudicating Authority wrongly. He

relied on the following decisions:-

CS T vs. Somani Exports – 2009 (13) STR 562 (Tri. Ahmd)

Brindoo Sales Ltd vs. CST – 2015 (40) STR 986 (Tri. Del)

4.1 Learned AR pointed out that the impugned order in para 8.9 clearly

states that suitable deduction for the exempted service has already been

given and already these services not covered has been confirmed. He argued

that the amount of Rs 1,11,32,454/- is the amount of commission received

in respect of services and not in respect of goods. He argued that the

benefit of exemption on services provided in respect of goods has already

been extended in Annexure B to the show cause notice. Learned AR

also submitted that the services provided by them is not merely in respect

of sales of goods but attending to the customers complaints also.

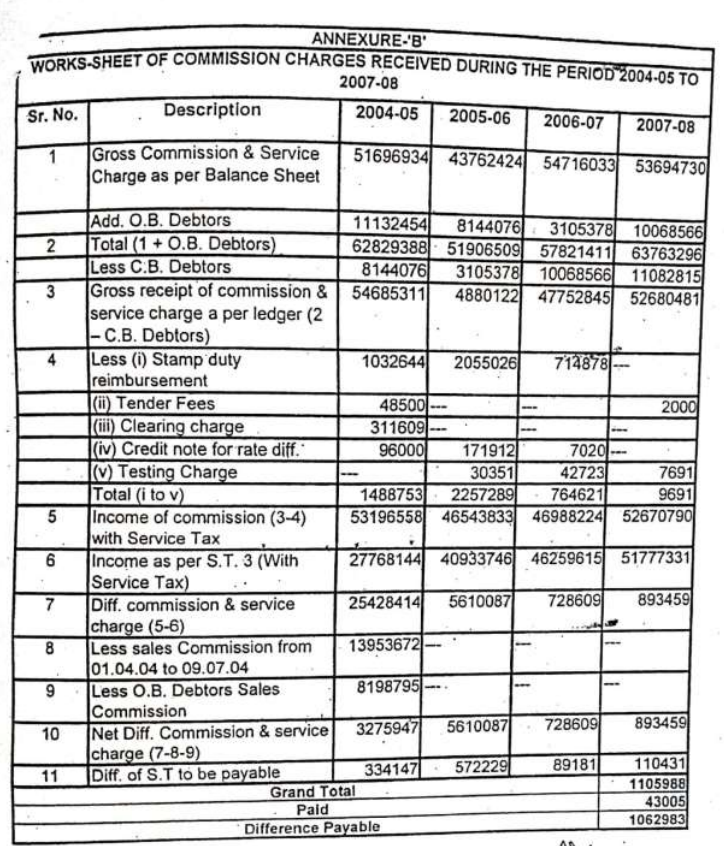

4.2 On the second issue regarding demand of service tax on the sales

commission and denial of Notification 13/03 –ST dated 20.06.2003 it is

noticed that the benefit of exemption notification has been extended in

the show cause notice itself. The perusal of annexure B of the show cause

notice shows that sales commission for the period 01.04.2004 to

09.07.2004 and the opening balance of debtors under the head of sale

commission has been excluded from the gross value for the purpose of

demand. Annexure B to the Show cause notice is reproduced below:

4.3 In this background the defence of the appellant that the benefit of

exemption notification on the sales commission has not been extended is

incorrect. However, we also find that the demand has been made without

examining the nature of commission received. The show cause notice

does not mention the nature of the commission received by the appellant.

The SCN merely picks up the head of commission in the balance sheet and

compares it with the ST- 3 return. The Order-In –Original also makes the

vague reference to commission received in respect of repairs and attending

to customers complaints. It is not understood how the services would

become taxable under the business auxiliary service. The appellant has

also not produced any documents to show the exact nature of the services

provided by them.

4.4 In this circumstances we left with no alternative but to set aside the

order and remand the matter back to the Original Adjudicating Authority

to decide a fresh after examining the actual contract under which such

payment has been received and specifically examine the nature of services

provided an its taxability. The appeal is allowed by way of remand.

The third issue raised relates to denial of cenvat credit on account of

certain defects in the documents on the strength of which the credit was

taken. Learned counsel pointed out that the SCN seeks to recover the

Cenvat credit of Rs 45,97,501/- taken by them during the period 2006-

2007 to 2007-2008 on the strength of debit notes issued by M/s Gupta

Metallics and Power Ltd and M/s Dhariwal & Doshi Industries Pvt Ltd. It

has been alleged in the SCN that when the said debit notes were issued

neither M/s Gupta Metallics and Power Ltd nor M/s Dhariwal & Doshi

Industries Pvt Ltd were registered with service tax department. It was

also alleged in the SCN that M/s Gupta Metallics Power Ltd have taken

the service tax registration on 01.06.2007 and M/s Dhariwal & Doshi

Industries Pvt Ltd have taken registration on 05.07.2006 i.e. subsequent to

the date of issue of debit notes.

5.1 Learned counsel pointed out that at the time of issue of debit notes

the service provider namely M/s Gupta Metallics and Power Ltd and M/s

Dhariwal & Doshi Industries Pvt Ltd had mentioned their service tax

registration obtain for GTA service. However, while at the time of

payment of service tax to the government treasury the registration

certificate was amended by the said service provider. He pointed out that

the said issue has been examined by the Tribunal in the following cases:-

Sanghi Industries Ltd Vs. CCE – 2009 (14) STR 462 (Tri. Ahmd)

Imagination Technologies India P. Ltd Vs. CCE – 2011 (23) STR 661

(Tri. Mum)

Secure Meters Ltd Vs. CCE – 2010 (18) STR 490 (Tri.- Del)

5.2 Learned AR relies on the impugned order. He also submitted a copy of

letter dated 21.01.2013 which relates to the verification conducted by

revenue in respect of such debit notes. The said report indicates that no

debit notes were issued by M/s Gupta Metallics and Power Ltd and M/s

Dhariwal & Doshi Industries Pvt Ltd during 2006 -2007and the same were

fake. However, 4 debit note issued by M/s Dhariwal & Doshi Industries Pvt

Ltd in the year 2007 -2008 were found to be genuine. Similarly debit notes

issued by M/s Gupta were found to be genuine. The revenue has placed

on record letter dated 21.01.2013 of Commissioner of Service Tax

Ahmedabad. The letter is reproduced below:-

“Please refer to your office letter F.No. ST/131/2012 dated

03.12.2012 on the above subject.

The total Cenvat credit Involved is Rs. 45,97,501/- out of which Rs.

33,07,708/- pertains to the Division –I of Central Excise Vadodara –

- The Dy. Commissioner, Vadodara –I has verified the relevant

Cenvat Credit Debit /notes and has found that the debit notes issued

during the year 2006 -07 involving service tax of Rs. 22,99,372/- were

not issued by M/s. Dhariwal & Doshi Industries Pvt Ltd and hence,

appear to be fake. Since the debit notes are fake with no entres in

the registers at their end, there is no question of issuing SCN.

Four debit notes issued by M/s. Dhariwal & Doshi Industries Pvt Ltd

in the year 2007 -2008 are involved in this case. The deputy

Commissioner, Service Tax, Division – III, Ahmedabad has verified

these four debit notes with the documents supplied by the Deputy

Commissioner, Vadodara –I and it is reported that service tax has

been paid in respect of these 4 debit notes viz., Debit Note No.

GEB/DR/02 dt. 24.08.2005, GEB/DR/03 dt. 31.12.2005, GEB/DR/01

- 5.5.2006 and GEB/DR/02 dt. 16.5.2006 involving total service tax

of Rs. 10,08,336/-.

Another Rs. 12,89,793/- pertains to Central Excise, Division

Chandrapur. The Dy Commissioner has verified an amount of Rs.

14,18,141/- ( including above Rs. 12,89,793/-) as admissible and

can be allowed. AC/DC report No. CNo. IV (11)

168/ST/Misc/Infor/2012, dtd 20.12.12 of DC Chandrapur along with

its enclosures is enclosed with this letter for perusal please.”

5.3 It is noticed that this report has been obtained after adjudication of

the case by the adjudicating authority and the same was not available at

the time of adjudication. Since this report was not available with the

adjudicating authority the decision could not have been taken after

examining complete facts. Consequently the demand on this issue is also

set aside and the matter is remanded back to the original Adjudicating

Authority.

In view of the above the demand is set aside and appeals are allowed

by way of remand.

(Pronounced in the open court on 12.01.2023

)

RAMESH NAIR

MEMBER (JUDICIAL)

RAJU

MEMBER (TECHNICAL)